Personal Financial Plan

A Personal Financial Plan is an integral component of your Master Exit Plan®.

You have focused your time, energy, capital, and expertise in growing your company for years, maybe decades. You have created wealth and security for your family and when it is time to harvest your riches and move onto the next chapter of your life you’ll need confidence that you can financially achieve your dreams.

“How do I know if selling my business will provide the level of financial security I want?”

Whether you aspire to travel the world, contribute to your community at a higher level, golf, see the grandkids, or build another business, you need to understand the impact of a liquidity event on your financial future when considering the sale of your business.

Our team will assess your current financial resources, including the integration of the market value of your business net of taxes and expenses, so that we can accurately project future investment returns. This will determine your ability to meet current and future financial goals. We then integrate this financial analysis into your Master Exit Plan to identify the optimal exit strategy that will meet your financial dreams.

Our financial planning process is robust with a high-level of detail. We utilize MoneyGuidePro®, a financial planning software that combines goal-based planning with cash flow after retirement. The software is granular and takes into consideration actuarial tables, inflation rates, tax rates, and also stress-tests investments for bear market conditions. We create your customized financial plan and set up a portal so that you can access your plan in real time, make changes, and immediately see the financial impact of these changes on your ability to reach your goals.

We provide extensive business and personal financial planning so that you understand your financial position before and after the sale of your business.

With your Personal Financial Plan, you’ll gain the optics needed to assess and strategize whether selling your business today will provide your desired financial security or if continued growth and better positioning of your company is needed for a greater liquidity return in the future.

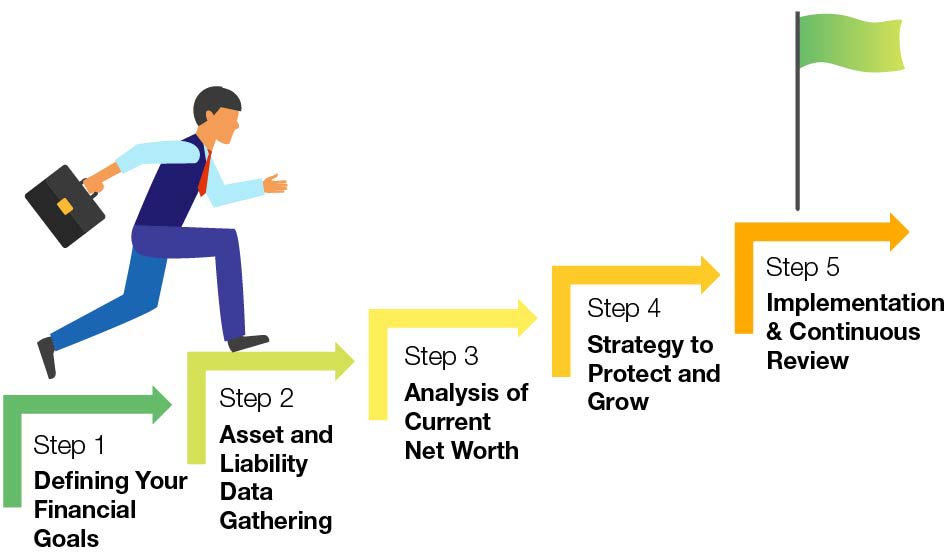

Step 1: Defining Your Financial Goals

Step 2: Asset and Liability Data Gathering

Step 3: Analysis of Current Net Worth

Step 4: Strategy to Protect and Grow

Step 5: Implementation & Continuous Review

When selling your business, a Personal Financial Plan may be an afterthought to many, but it is an integral part of the process. By giving it proper attention in the exit planning process, we can avoid potential pitfalls that may impact your financial security and happiness post-sale.

Contact Us

info@legacypartnersllp.com

US Based with Global Reach

617.314.9606

Copyright © 2023 Legacy Partners LLC | Exit Planning Advisors